The California consumer privacy act (CCPA) is a law that was passed in 2018, and it is in effect from January 1st 2020. The California attorney general’s office has not taken any enforcement action against firms that did not meet the standards until July 1st 2020. A lot of people are unsure about what this new law means for them. Like the GDPR, there are significant penalties for non-CCPA compliance and potential loss of consumer loyalty.

CCPA is also referred to as California’s “Gigantic Big Brother” law because it exposes more information than ever before. This blog post will cover everything about the California consumer privacy act (CCPA).

What is the California consumer privacy act?

The CCPA is a consumer privacy act that was passed in California on June 28th 2018. The law requires businesses to protect the personal data they collect, and it gives consumers more control over their personal information.

One of its main goals is protecting user privacy online by regulating how all companies must handle customers’ private information. It holds these companies accountable for private data breaches, as well as requires all businesses to disclose what information they have collected about their customers who are California residents.

It requires companies to be transparent with how consumers’ personal information is being used or sold, and it offers consumers the ability to opt-out of sharing some types of personal data. The CCPA also gives users more control over how their data is used.

It holds businesses accountable for any breaches, and it requires all companies to disclose what information they have collected about their users. It also gives consumers the ability to not share certain types of consumer data with these companies.

CCPA provisions

The CCPA includes several provisions that go into effect on January one, 2020, including:

1. The right for consumers to opt out of businesses selling their personal information and data.

2. Requirements that companies notify users when there is a security breach involving their private information.

3. A requirement for businesses to offer “clear and conspicuous choice” to customers about whether they want the company to use, share or sell their personal information.

4. A requirement that businesses disclose what kinds of information they collect and how it is being used or shared with third parties.

5. The ability to sue companies who violate the CCPA for damages between $100-$750 per violation (or actual harm if more significant). Companies face fines up to $25,000 a day for violations.

6. The ability to collect fines of up to $100 for each individual who has not been offered the “clear and conspicuous choice” regarding whether their personal information will be used or sold, while businesses can face daily fines of up to $750 per violation (or actual harm if more significant). Companies may also receive civil penalties of between $15,000 and $75,000 per individual who has been harmed by the violation.

7. A requirement for companies to delete personal information once it is no longer needed for a specific business purpose, as well as new rules on transparency with users about what data these businesses are collecting.

What is CCPA compliance in California?

The California consumer privacy act (CCPA) compliance is the process of making sure all businesses are following the new rules that have been put into place. It requires a lot more transparency about how businesses collect and use consumer data, as well as giving consumers much more control over this information.

It means being in full compliance with the new rules that have been put into place by California’s consumer data privacy act. It requires a lot more transparency about how businesses collect and use consumer data, giving consumers much more control over this information.

How does the California consumer data privacy act affect me?

The CCPA is a consumer privacy act that affects every company in the State of California. There are also some other states which have similar laws, including Nevada and Colorado.

The biggest impact will be on how all companies must handle and protect consumer data collection from customers or users who are California residents. This means that businesses need to update their privacy policies and maintain reasonable security procedures to ensure they comply with the new law.

For example, all businesses must notify customers of any data breaches and give them the option to opt-out if they so choose. They also need to provide clear and conspicuous notice regarding all personal information collected from their users or customers, how it will be used or shared with third parties, and let these individuals know that they have the ability to opt-out of having their sensitive data sold or shared.

Every business should be aware of how this new law will affect them and what they need to do to ensure compliance. One of its main goals is protecting user privacy online by regulating how all companies must handle customer data.

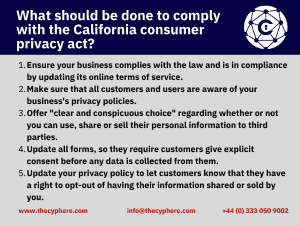

What should be done to comply with the California consumer privacy act?

Following are some steps that should be taken by all businesses who have annual revenue of $25 million or more and their customer base involves California consumers.

1. Ensure your business complies with the law and is in compliance by updating its online terms of service, as well as offering users a clear “opt-out” option for sharing their personal information or having it sold.

2. Make sure that all customers and users are aware of your business’s privacy policies.

3. Offer “clear and conspicuous choice” regarding whether or not you can use, share or sell their personal information to third parties.

4. Update all forms, so they require customers give explicit consent before any data is collected from them. This includes having a transparent box on the form to check to state, “I consent”.

5. Update your privacy policy to let customers know that they have a right to opt-out of having their information shared or sold by you. You must also give them clear instructions on how this can happen and who will be reached for more questions.

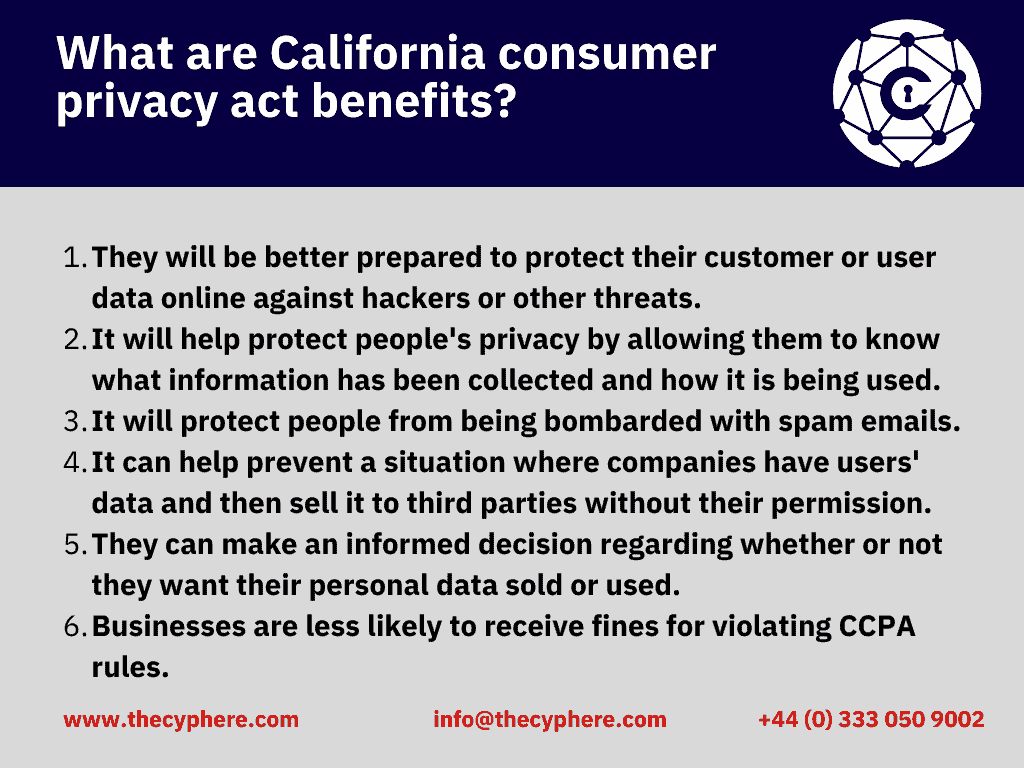

What are California consumer privacy act benefits?

CCPA will make it easier for people to understand how their data is being collected and give them more control over what companies can do with the information they provide. Following are some major benefits of CCPA:

- They will be better prepared to protect their customer or user data online against hackers or other cyber threats.

- It will help protect people’s privacy by allowing them to know what information has been collected and how it is being used.

- It will protect people from being bombarded with spam emails.

- It can help prevent a situation where companies have users’ data and then sell it to third parties without their permission.

- They can make an informed decision regarding whether or not they want their personal data sold or used, meaning they are in control of the situation rather than companies.

- Businesses are less likely to receive fines for violating California consumer privacy act rules, which can add up quickly if they do not comply with the new privacy law.

What should I know about the CCPA?

The CCPA will affect all businesses that have customers or users in California and have annual revenue of more than $25 million. Even if your company does not have a physical presence there, it must still comply with the new customer data collection and sharing rules.

Some other states have similar laws to the California consumer privacy act, including Nevada and Colorado. Each state has its own particular consumer privacy act rules, including what businesses must do to comply with California law. This means that everyone needs to make sure they are up to date on their requirements for each one separately.

Which personal data comes under CCPA?

This means that the CCPA does not apply to all types of personal information. Only data that relates to a person’s commercial activities and is linked with their identity falls under the CCPA requirement. This includes different elements defining what constitutes sensitive data:

- Name.

- Postal address.

- Telephone number.

- Email address.

- Social security number.

- Credit card or other banking details.

- Driver’s license number.

- Financial account number.

What kinds of data are not covered by the CCPA?

The following types of data are not covered by CCPA:

- Personal emails sent between people are usually exempt from California consumer privacy act rules unless the messages include commercial content related to the recipient’s business.

- Personal information which is encrypted or otherwise protected cannot be shared with the California consumer privacy act.

- California consumer privacy act rules do not apply to personal messages which are sent between individuals.

- Data that has been anonymised is also exempt from California consumer privacy act rules, as there would no longer be an identifiable individual linked to it.

- Data collected only for scientific or historical research is also exempt from California consumer privacy act rules, along with information that is publicly available elsewhere. This includes things like government documents and court records.

What are California consumer privacy act requirements?

There are some CCPA requirements that all companies must meet. These include:

1. Allowing users to see the information you have collected on them and how it is being used, as well as asking for their consent before sharing or selling consumers personal information.

2. Ensuring that any third parties who are given access to CCPA data are also fully compliant with California consumer privacy act rules.

3 Providing clear instructions on how users can opt-out of their data sharing or selling, and making sure that the process is free and easy to do for everyone who wants it.

4. To further protect people’s California consumer privacy act rights, companies are also required to establish a CCPA data breach procedure.

What about California consumer privacy act penalties?

It is essential that everyone involved with California consumer privacy act compliance understands the consequences of not doing so for their business. This includes both potential fines and other CCPA liabilities.

1. Those who violate California consumer privacy act rules will be subject to fines of up to $750 for each violation. These penalties can quickly add up if a company is not in compliance with the CCPA, which could have severe consequences for their bottom line.

2. Companies are also responsible for paying the costs of CCPA enforcement, which can be very expensive for large corporations.

3. California consumer privacy act penalties are not the only CCPA liabilities that companies have to be aware of. For example, they could also face class-action lawsuits from customers if their data is breached or shared inappropriately by a third party.

4. Companies that are found to not have CCPA compliance could also face legal consequences because of this. This means they may need to pay damages or other compensation to individuals whose personal data was compromised in some way due to California consumer privacy act non-compliance.

Who is responsible for CCPA compliance in an organisation?

The California consumer privacy act compliance process is not something that any one person or department in a company can be responsible for. However, a California consumer privacy act compliance officer or a team often leads it.

CCPA teams are usually made up of privacy experts from various areas across the company, including IT and legal departments and marketing and sales divisions. This allows for the compliance to be approached from many different angles, making sure California consumer privacy act requirements are met across the board.

What is the easy way for CCPA compliance?

While California consumer privacy act compliance is not necessarily an easy task, some companies have made it easier for themselves. For example:

One way is by using California consumer privacy act software to automate California consumer privacy act processes and help ensure that all the compliance requirements are met throughout the organisation. This software is entirely California consumer privacy act compliant, meaning it will work within California consumer privacy act rules to help make California consumer privacy act compliance as straightforward as possible.

Another way is by choosing a California consumer privacy act provider who has already established themselves in the industry with years of experience behind them, helping businesses meet the requirements in a way that is both straightforward and cost-effective.

Get in touch to discuss your privacy concerns or schedule a vulnerability or penetration testing assessment. We help businesses incorporate the data privacy model according to the business needs and processing requirements.

Shahrukh, is a passionate cyber security analyst and researcher who loves to write technical blogs on different cyber security topics. He holds a Masters degree in Information Security, an OSCP and has a strong technical skillset in offensive security.